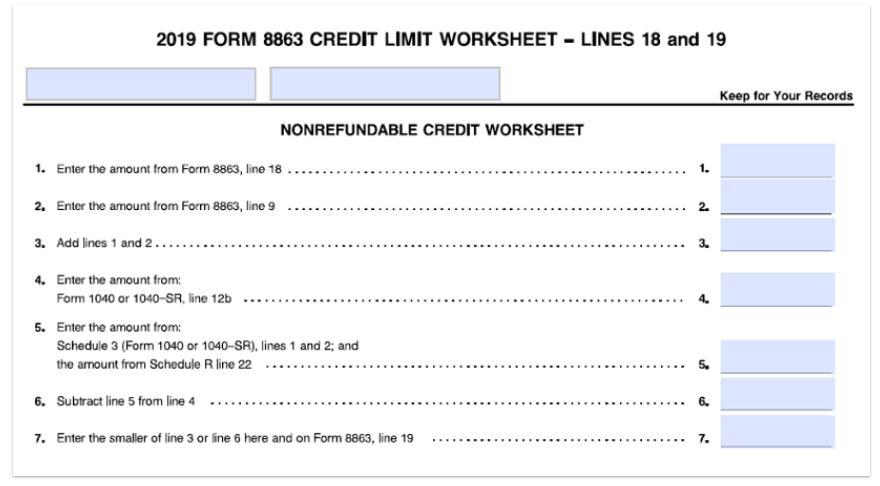

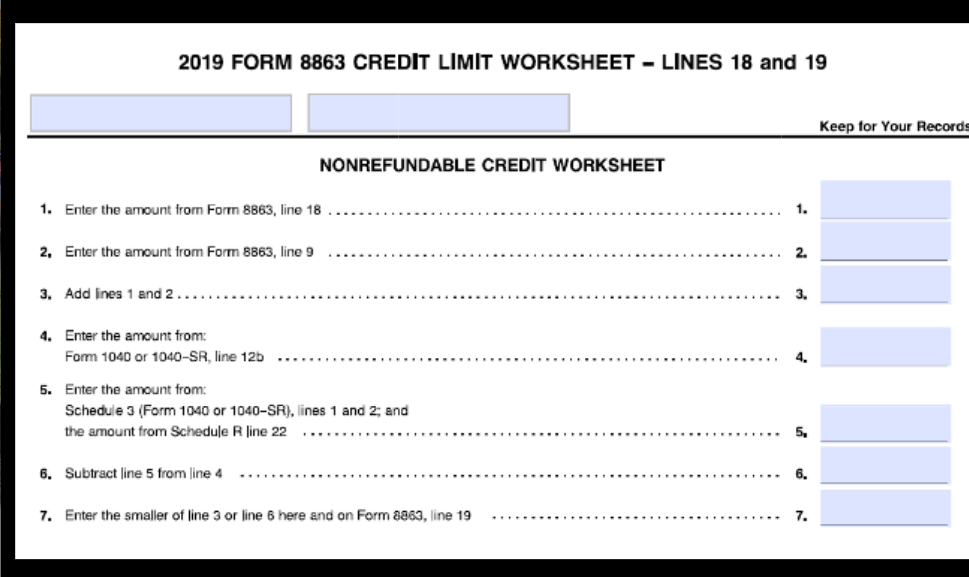

Credit Limit Worksheet 2019

For tax year 2019 the CTC phase-out begins at 200000 of AGI for single filers and heads of household. You may be able to take a credit equal to the sum of.

I Just Need Help On The 2 Blanks At The Bottom Pl Chegg Com

I Just Need Help On The 2 Blanks At The Bottom Pl Chegg Com

The maximum credit you can claim per year is 2000 based on 10000 in qualifying expenses.

Credit limit worksheet 2019. Phase-out for higher-income taxpayers Like many tax credits and deductions the Lifetime Learning credit phases out for higher-income taxpayers. Add the credit to the amount on line 9 and replace the amount on line 9 with that total. However this credit is limited as follows.

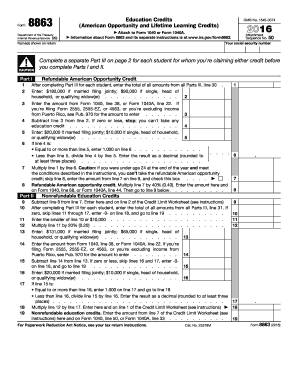

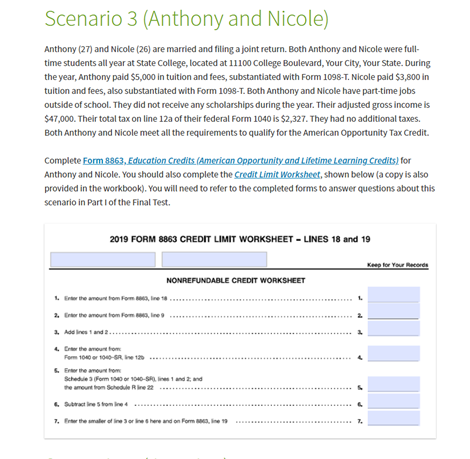

The amount you get on line 13 of the worksheet goes on Form 8863 line 19 and is the amount of nonrefundable credit you will receive -- the amount that will reduce the taxes you owe. To be eligible to claim the American opportunity credit or the lifetime learning credit the law requires a taxpayer or a dependent to have received Form 1098-T Tuition Statement from an eligible educational. Sharon claimed the American opportunity credit on her 2019 tax return.

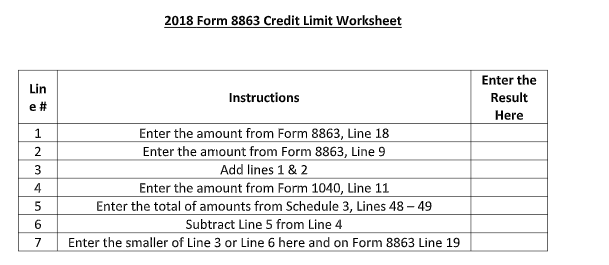

The Young Child Tax Credit was introduced in tax year 2019. For joint filers the credit begins to phase out at 400000. Credit Limit Worksheet 2018.

To figure the credit see Worksheet A in Pub. Start a free trial now to save yourself time and money. Therefore the American opportunity credit cannot be claimed for Sharon for 2020.

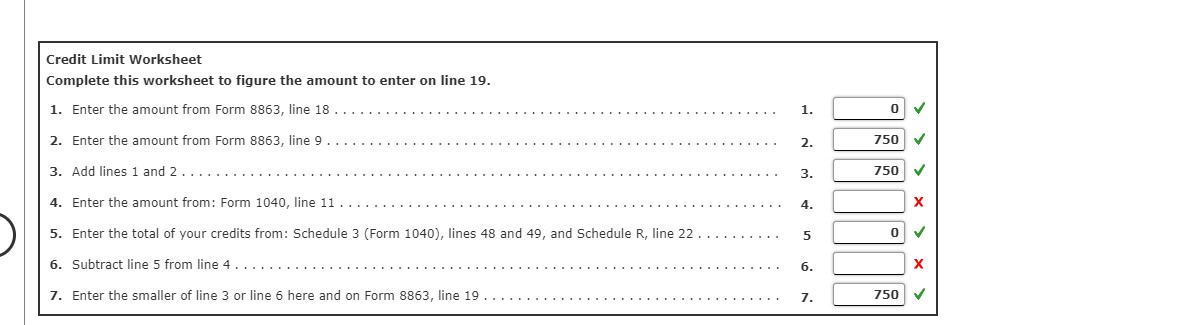

Complete the Credit Limit Worksheet using the amount from line 18 on line 1 of the worksheet. Before you complete the following worksheet figure the amount of any credit for the elderly or the disabled youre claiming on Schedule 3 Form 1040 line 6. If you can take a credit for your 2019 expenses enter the amount of the additional credit and CPYE Credit for Prior Year Expenses on the dotted line next to line 9.

Both requirements must be met. Available for PC iOS and Android. Reminders Form 1098-T requirement.

This temporary relief is provided through the Taxpayer Certainty and Disaster Tax Relief Act of 2020. 1 Child must be under age 17 at the end of 2019 and 2 Child must meet the other requirements listed under Child Tax Credit and Credit for Other Dependents page 11-7 TheTaxBook 1040 EditionDeluxe Edition. Any residential energy property costs paid or incurred in 2019.

A total combined credit limit of 500 for all tax years after 2005. You may go back up to four years to claim CalEITC by filing or amending a state income tax return. Under the terms of his.

Specific Instructions Column b 1. The requirements for the American opportunity credit. The facts are the same as in 9701 except that Bill was awarded a 5600 scholarship.

A combined credit limit of 200 for windows for all tax years after 2005. You cant claim any of the credit if your income is more than 240000. Earned Income Worksheet 1 Enter amount from line 1 Form 1040.

Tools or Ta ros TheTaxBook Earned Income Credit EIC Worksheet See Earned Income Creditpage 11-8 TheTaxBook 1040 EditionDeluxe Edition for information on who qualifies for the Earned Income Credit. The undersigned certify that as of June 22 2019 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version June 22 2019 published by the Web Accessibility. Credit Limit Worksheet Complete this worksheet to figure the amount to enter on line 11.

If you qualify for CalEITC and have a child under the age of 6 as of the end of the tax year you may qualify for up to 1000 through this credit. For 2020 single filers with an AGI of 32500 or more head of household filers with AGI of 48750 or more and joint filers with an AGI of 65000 or more are ineligible to claim the credit. A credit limit for residential energy property costs for 2020 of 50 for any advanced main air circulating fan.

If your earned income was higher in 2019 than in 2020 you can use the 2019 amount to figure your EITC for 2020. If Sharon were to file Form 8863 for 2020 she would check Yes for Part III line 23 and would be. It phases out completely at 440000.

Credit MAGI limits remain unchanged. He figures his American opportunity credit based on qualified education expenses of 4000 which results in a credit of 2500. To figure the credit see Publication 596 Earned Income Credit.

The American opportunity credit has been claimed for Sharon for 4 tax years before 2020. See Schedule R Form 1040 to figure the credit. 10 of the amount paid or incurred for qualified energy efficiency improvements installed during 2019 and 2.

The most secure digital platform to get legally binding electronically signed documents in just a few seconds. Fill out securely sign print or email your credit limit worksheet form instantly with SignNow. Names shown on return.

150 for any qualified natural gas propane or oil furnace or hot water boiler. Earned Income Tax Credit EITC Relief. And 300 for any item of energy efficient building property.

Form 1040 or 1040-SR filers. Your Adjusted Gross Income AGI must fall below the income limits for your filing status. Or Form 1040-NR line 45.

Child Tax Credit and Credit for Other Dependents Worksheet 2019 Qualifying child for the Child Tax Credit. Enter the amount from Form 1040 or 1040-SR line 12b. Complete this worksheet to figure the amount to enter on line 11.

See Table 1 and the instructions for line 3 or line 14.

Credit Limit Worksheet Taxes Printable Worksheets And Activities For Teachers Parents Tutors And Homeschool Families

Credit Limit Worksheet Taxes Printable Worksheets And Activities For Teachers Parents Tutors And Homeschool Families

Instructions For Form 8582 Cr 12 2019 Internal Revenue Service

Instructions For Form 8582 Cr 12 2019 Internal Revenue Service

Credit Limit Worksheet Fill Online Printable Fillable Blank Pdffiller

Credit Limit Worksheet Fill Online Printable Fillable Blank Pdffiller

Instructions For Form 8995 A 2020 Internal Revenue Service

Instructions For Form 8995 A 2020 Internal Revenue Service

Learn How To Fill The Form 8863 Education Credits Youtube

Learn How To Fill The Form 8863 Education Credits Youtube

Form 8880 Tax Incentives For Retirement Account Contributions Filetaxes Online Blog

Form 8880 Tax Incentives For Retirement Account Contributions Filetaxes Online Blog

Credit Limit Worksheet Fill Out And Sign Printable Pdf Template Signnow

Credit Limit Worksheet Fill Out And Sign Printable Pdf Template Signnow

Https Www Irs Gov Pub Irs Prior I8839 2019 Pdf

Credit Limit Worksheet 8880 Credit Quotes Credit Score Quotes Financial Quotes

Credit Limit Worksheet 8880 Credit Quotes Credit Score Quotes Financial Quotes

Tax Form 2441 Instructions Info On Child Dependent Care Expenses

Tax Form 2441 Instructions Info On Child Dependent Care Expenses

Fill Free Fillable Form 8863 Education Credits Pdf Form

Fill Free Fillable Form 8863 Education Credits Pdf Form

Publication 974 2019 Premium Tax Credit Ptc Internal Revenue Service

Publication 974 2019 Premium Tax Credit Ptc Internal Revenue Service

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Case Information John And Mary Remington Are Marri Chegg Com

Case Information John And Mary Remington Are Marri Chegg Com

Instructions For Form 8889 2020 Internal Revenue Service

Instructions For Form 8889 2020 Internal Revenue Service