1040 28 Rate Gain Worksheet

See Before completing this worksheet complete Form 1040 through line 11b. For details on unrecaptured section 1250 gain see the instructions for line 19.

Http Www Thetaxbook Com Updates Thetaxbook Client 20tax 20tools 2018 Unrecaptured Section 1250 Gain Worksheet Pdf

2012 28 Rate Gain.

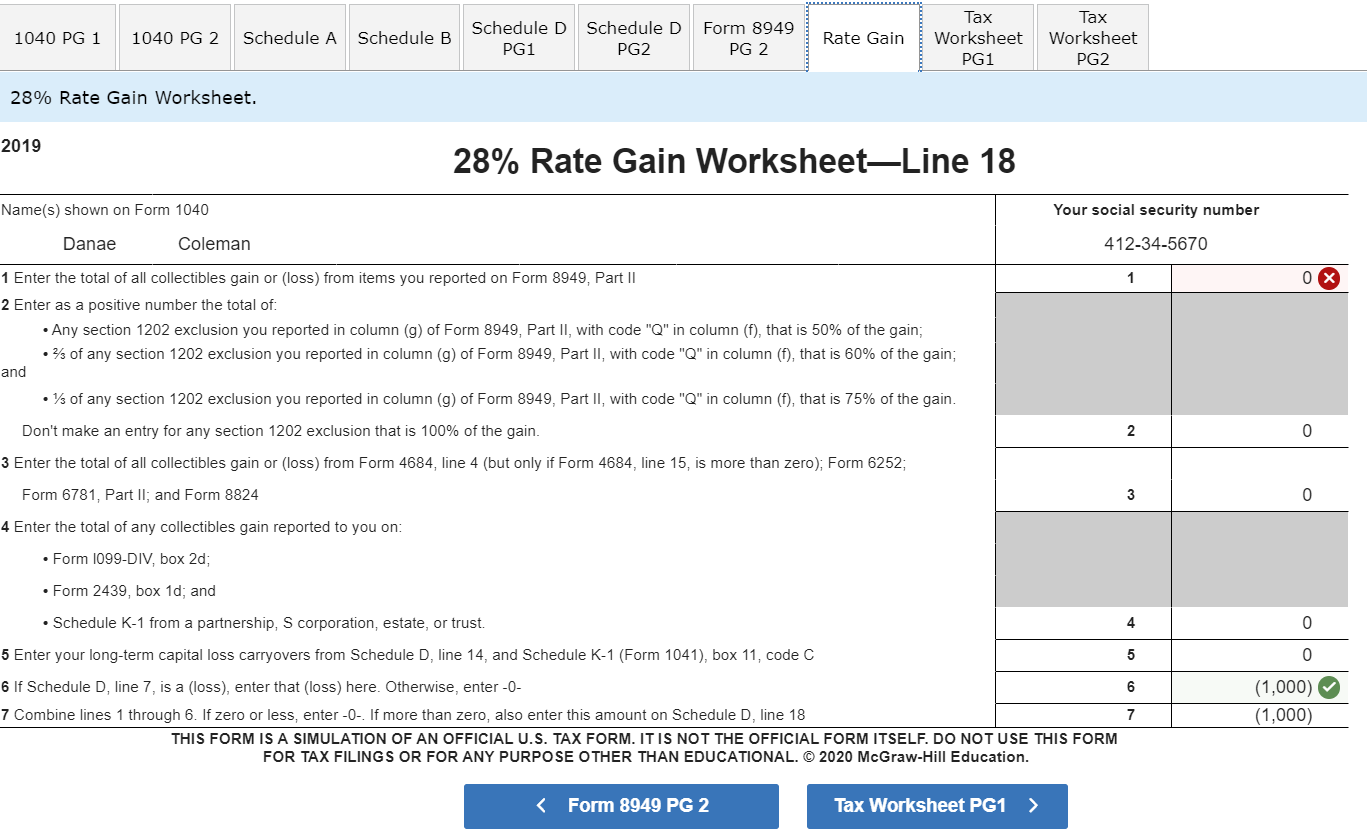

1040 28 rate gain worksheet. And line 16 of the Unrecaptured Section 1250 Gain Worksheet for Schedule D line 19. 1 2 Enter as a positive number the total of. The maximum tax rate on collectibles gain is 28 percent.

In TaxSlayer Pro the 28 Rate Gain Worksheet and the Unrecaptured Section 1250 Gain Worksheet are produced automatically as needed but there are amounts that may need to be entered on either worksheet by the preparer. Any section 1202 exclusion reported in column g of Form 8949 Part II with code Q in column f that is 50 of the gain. 2013 28 Rate Gain Worksheet Form 1040 Schedule D Instructions Page D-11.

Form 1040 instructions for line 12a to see if the taxpayer can use this worksheet to compute the taxpayers tax. For details on 28 rate gain see the instructions for line 18. Don t include Form 1095-A Health Coverage Reporting.

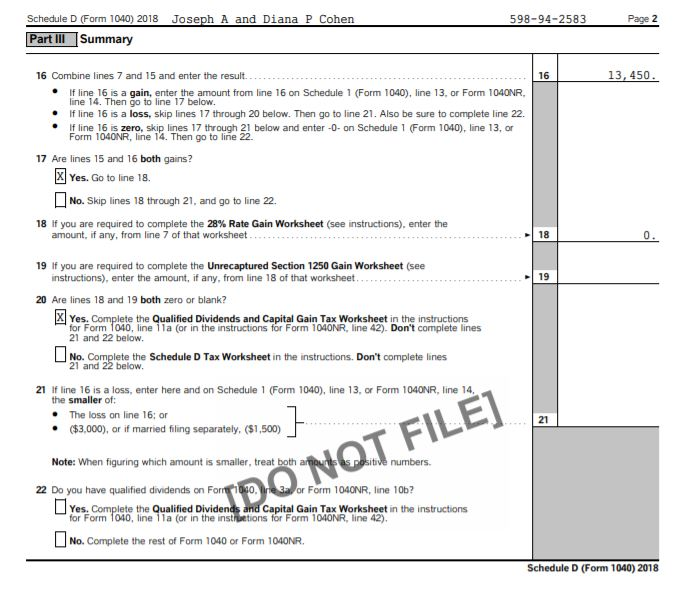

28 Rate Gain Worksheet 2018 1 Enter the total of all collectibles gain or loss from items you reported on Form 8949 Part II. 1250 gain is reported. Line 18 If you checked Yes on line 17 complete the 28 Rate Gain Worksheet in the.

To figure your tax on collectibles gain you have to use the worksheet on page 8 of Form 1040 Schedule D instructions. A sale or other disposition of an interest in a partnership may result in ordinary income collectibles gain 28 rate gain or unrecaptured section 1250 gain. Part II of Form 1095-C shows whether your employer offered you health insurance coverage and if.

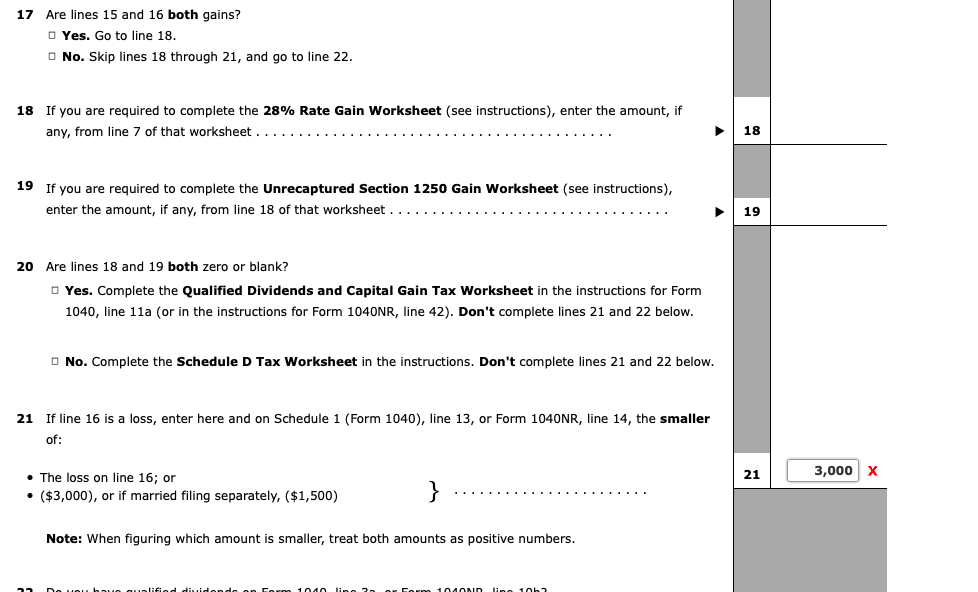

Most taxpayers who file Schedule D do not have amounts on line 18 which contains capital gain taxed at the 28 rate or line 19 where unrecaptured Sec. Adjust 28 Rate1250 Worksheets - The 28 Rate Gain Worksheet and the Unrecaptured Section 1250 Gain Worksheet are produced automatically as needed with information provided elsewhere on the return however each worksheet has several lines that may need direct editing. Clude that amount on line 4 of the 28 Rate Gain Worksheet in these instruc-tions if you complete line 18 of Sched-ule D.

If you received capital gain distribu-tions as a nominee that is they were paid to you but actually belong to some-. If you or someone in your family was an employee in 2020 the employer may be required to send you Form 1095-C. To access the both worksheets in TaxSlayer Pro from the Main Menu of the tax return Form 1040 select.

Line 5 of the 28 Rate Gain Worksheet for Schedule D line 18. Any section 1202 exclusion you reported in column g of Form 8949 Part II with code Q in column f that is 50. Override on the forms.

A long-term capital loss carryover reported as code C is reported as appropriate on Schedule D Form 1040 line 12. Fill out this section of the IRS Schedule D tax worksheet in a similar manner as including the Capital Loss Carryover Worksheet 28 Rate Gain Workshee 2014 28 Rate Gain Worksheet Form 1040 Schedule D Instructions Page D-12. The corrected worksheet results in a lower regular tax for most taxpayers and a higher regular tax for a small number of taxpayers.

Include Form 8962 with your Form 1040 Form 1040-SR or Form 1040-NR. SCHEDULE D Form 1040 or 1040-SR Department of the Treasury Internal Revenue Service 99 Capital Gains and Losses Attach to Form 1040 1040-SR or 1040-NR. Intuit ProConnect Lacerte calculates the 28 rate on capital gains according to the IRS form instructions.

To ask a question on Tax. If you received capital gain distribu-tions as a nominee that is they were paid to you but actually belong to some-one else report on Schedule D line 13 only the amount that belongs to you. 1 2 Enter as a positive number the total of.

If the taxpayer does not have to file Schedule D Form 1040 and received capital gain distributions be sure the box on line 6 Form 1040 is. 28 Rate Gain Worksheet 1 Enter the total of all collectibles gain or loss from items reported on Form 8949 Part II. When the long-term capital loss carryover is forced on Screen BD in the Income Folder the 28 Rate Capital Gain line 5 and Unrecaptured Section 1250 line 16 Worksheets do not report the forced amount.

If you received capital gain distribu-tions as a nominee that is they were paid to you but actually belong to some-. If there is an amount on Line 18 from the 28 Rate Gain Worksheet or Line 19 from the Unrecaptured Section 1250 Gain Worksheet of Schedule D Form 1040 Capital Gains and Losses according to the IRS the tax is calculated on the Schedule D Tax Worksheet instead of the Qualified Dividends and Capital Gain Tax Worksheet. If there is an amount in box 2d in-clude that amount on line 4 of the 28 Rate Gain Worksheet in these instruc-tions if you complete line 18 of Sched-ule D.

If there is an amount in box 2d in-clude that amount on line 4 of the 28 Rate Gain Worksheet in these instruc-tions if you complete line 18 of Sched-ule D. Per the instructions the 28 rate will generate if an amount is present on Schedule D lines 18 andor 19. The tax calculation did not work correctly with the new TCJA regular tax rates and brackets for certain Schedule D filers who had 28 rate gain taxed at a maximum rate of 28 reported on line 18 of Schedule D or unrecaptured section 1250 gain taxed at a maximum rate of 25 reported on line 19 of Schedule D said the IRS.

Exclusion of Gain on Qualified Small Business QSB Stock later. Exclusion of Gain on Qualified Small Business QSB Stock later.

Gain Or Loss Worksheet Printable Worksheets And Activities For Teachers Parents Tutors And Homeschool Families

Gain Or Loss Worksheet Printable Worksheets And Activities For Teachers Parents Tutors And Homeschool Families

Capital Gain And Loss Worksheet Printable Worksheets And Activities For Teachers Parents Tutors And Homeschool Families

Capital Gain And Loss Worksheet Printable Worksheets And Activities For Teachers Parents Tutors And Homeschool Families

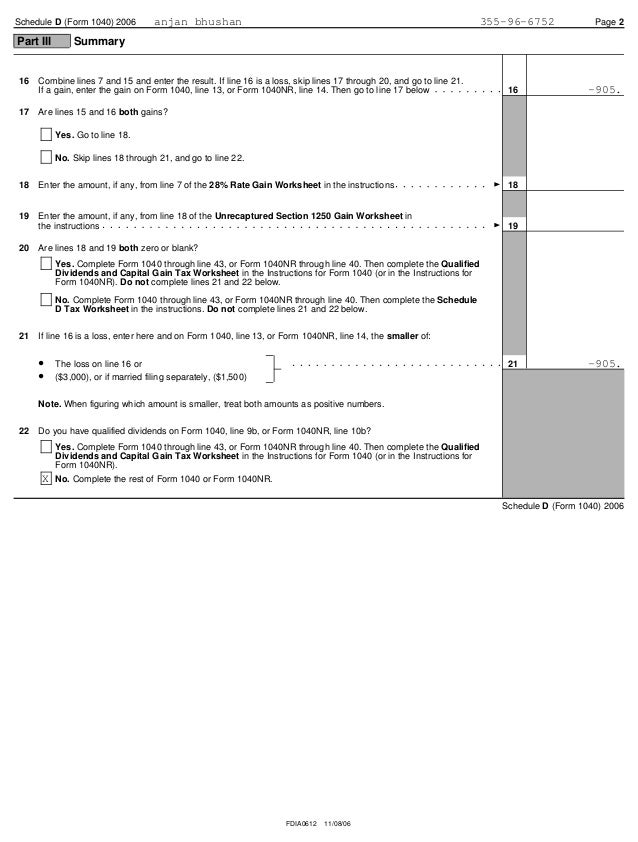

Solved Complete A 1040 Schedule D For This Assignment Yo Chegg Com

Solved Complete A 1040 Schedule D For This Assignment Yo Chegg Com

Solved How To Report These On Schedule D Tax Return James Chegg Com

Solved How To Report These On Schedule D Tax Return James Chegg Com

Fill Free Fillable Capital Gains And Losses 1040 Pdf Form

Fill Free Fillable Capital Gains And Losses 1040 Pdf Form

Http Www Thetaxbook Com Updates Thetaxbook Client 20tax 20tools 2019 Unrecaptured Section 1250 Gain Worksheet Pdf

Tax Project Can You Help Me Fill Out Schedule D F Chegg Com

Tax Project Can You Help Me Fill Out Schedule D F Chegg Com

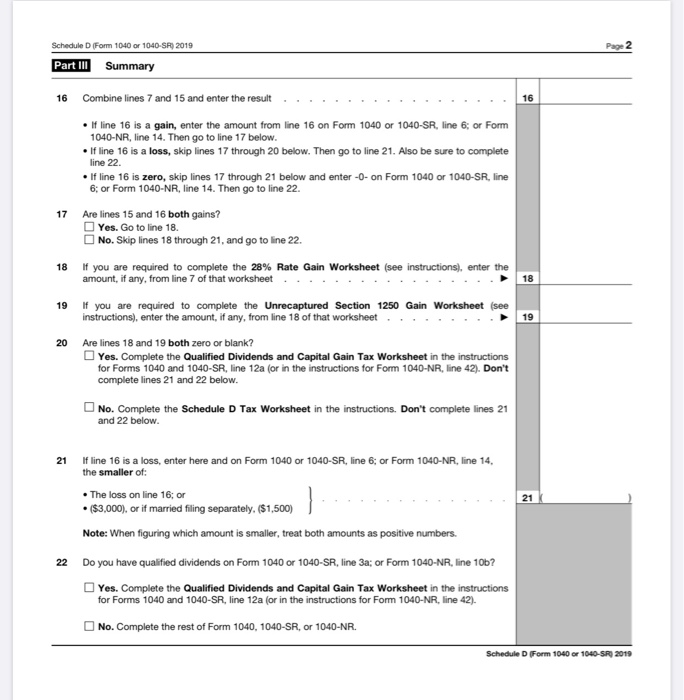

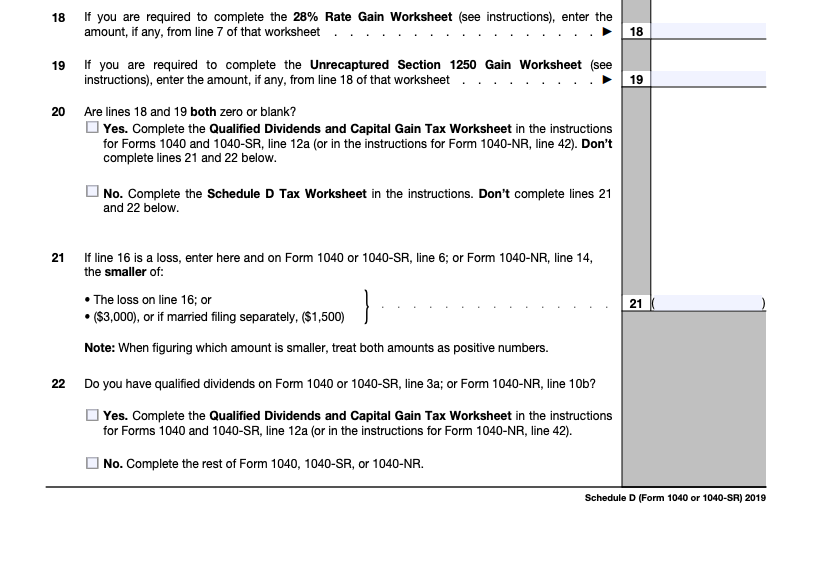

Irs 1040 Schedule D 2019 Fill And Sign Printable Template Online Us Legal Forms

Irs 1040 Schedule D 2019 Fill And Sign Printable Template Online Us Legal Forms

I Need Help Filling Out 1040 Schedule 1 Schedule Chegg Com

I Need Help Filling Out 1040 Schedule 1 Schedule Chegg Com

28 Rate Gain Fill Online Printable Fillable Blank Pdffiller

28 Rate Gain Fill Online Printable Fillable Blank Pdffiller

Https Www Irs Gov Pub Irs Prior F1040sd 1998 Pdf

/SchedD-59e44eca73a940459e36066f830ebf63.jpg) Schedule D Capital Gains And Losses Definition

Schedule D Capital Gains And Losses Definition

Form 1040 Schedule D Capital Gains And Losses

Form 1040 Schedule D Capital Gains And Losses

The Images Attached Are What I Need To Put These N Chegg Com

The Images Attached Are What I Need To Put These N Chegg Com

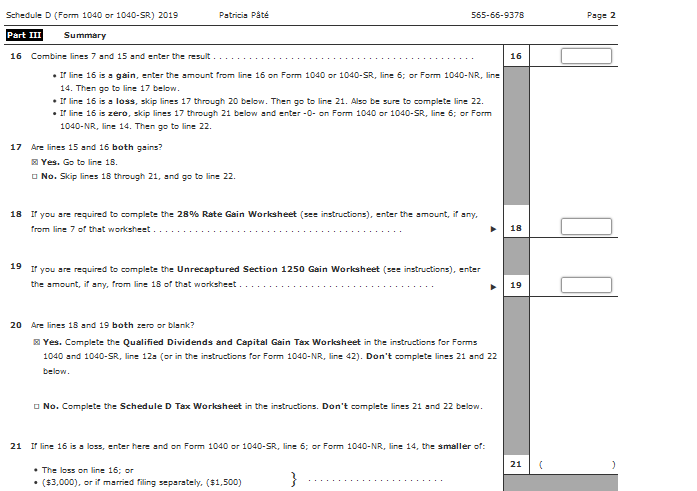

Note This Problem Is For The 2018 Tax Year Logan Chegg Com

Note This Problem Is For The 2018 Tax Year Logan Chegg Com

Publication 17 Your Federal Income Tax Chapter 17 Reporting Gains And Losses Comprehensive Example